Not known Details About Transaction Advisory Services

Table of ContentsTransaction Advisory Services - An OverviewExcitement About Transaction Advisory ServicesNot known Details About Transaction Advisory Services Excitement About Transaction Advisory ServicesSome Known Facts About Transaction Advisory Services.

This action sees to it business looks its best to potential purchasers. Getting business's worth right is crucial for an effective sale. Advisors make use of different approaches, like affordable capital (DCF) analysis, contrasting with similar firms, and recent transactions, to determine the reasonable market worth. This assists set a fair rate and discuss efficiently with future purchasers.Transaction advisors step in to help by obtaining all the needed information organized, addressing concerns from buyers, and setting up check outs to the service's area. Deal consultants utilize their experience to aid company owners manage hard arrangements, meet buyer assumptions, and structure deals that match the proprietor's goals.

Meeting lawful policies is important in any kind of company sale. Purchase advisory solutions deal with legal experts to produce and evaluate agreements, agreements, and other legal papers. This minimizes threats and makes certain the sale complies with the legislation. The duty of purchase consultants expands past the sale. They aid entrepreneur in preparing for their next actions, whether it's retired life, beginning a new endeavor, or handling their newfound riches.

Transaction consultants bring a wealth of experience and expertise, guaranteeing that every element of the sale is handled properly. Through calculated preparation, assessment, and negotiation, TAS helps business owners accomplish the greatest feasible list price. By ensuring legal and regulative conformity and handling due persistance along with other bargain employee, deal consultants minimize possible risks and liabilities.

Some Known Details About Transaction Advisory Services

By contrast, Large 4 TS teams: Service (e.g., when a potential buyer is carrying out due persistance, or when a bargain is shutting and the customer needs to integrate the firm and re-value the seller's Balance Sheet). Are with fees that are not connected to the bargain shutting efficiently. Earn charges per interaction someplace in the, which is less than what financial investment financial institutions gain also on "tiny deals" (yet the collection chance is also a lot greater).

The meeting inquiries are really similar to financial investment banking interview questions, however they'll concentrate a lot more on audit and valuation and less on topics like LBO modeling. Anticipate questions regarding what the Change in Working Capital ways, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like test balances and exactly how to walk through occasions making use of debits and credit scores rather than monetary statement changes.

Getting My Transaction Advisory Services To Work

that demonstrate just how both metrics have changed based on items, networks, and customers. to judge the precision of monitoring's past forecasts., consisting of aging, inventory by item, ordinary levels, and provisions. to identify whether they're completely imaginary or rather believable. Professionals in the TS/ FDD groups may likewise interview management regarding every little thing over, and they'll create a thorough record with their findings at the end of the process.

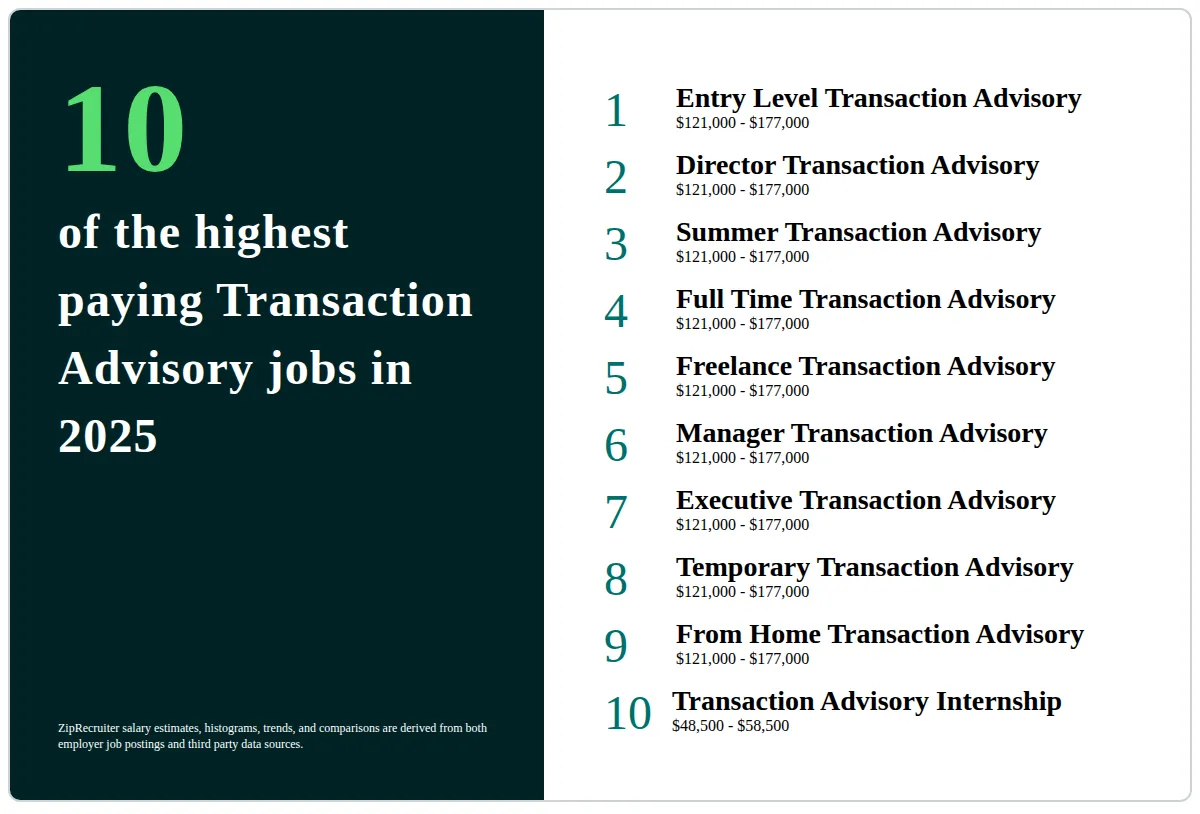

, and the general shape looks like this: The entry-level function, where you do a great deal of information and financial analysis (2 years for a promotion from below). The following degree up; comparable job, but you obtain the even more interesting little bits (3 years for a promo).

Specifically, it's difficult to get advertised past the Supervisor level due to the fact that couple of people leave the task at that phase, and you require to begin revealing proof of your capacity to produce income to development. Allow's start with the hours and lifestyle given that those are simpler to explain:. There are periodic late nights and weekend break job, however absolutely nothing home like the frenzied nature of that site investment financial.

There are cost-of-living changes, so expect reduced payment if you're in a less costly place outside significant monetary (Transaction Advisory Services). For all positions except Partner, the base income makes up the bulk of the total compensation; the year-end incentive may be a max of 30% of your base income. Commonly, the most effective means to boost your profits is to change to a different firm and bargain for a higher salary and bonus

The 7-Second Trick For Transaction Advisory Services

At this phase, you need to simply remain and make a run for a Partner-level function. If you want to leave, maybe relocate to a customer and do their evaluations and due persistance in-house.

The primary issue is that due to the fact that: You generally require to sign up with another Large 4 group, such as audit, and job there for a couple of years and afterwards relocate into TS, work there for a couple of years and afterwards move right into IB. And there's still no assurance of winning this IB duty due to the fact that it depends upon your area, customers, and the hiring market at the time.

Longer-term, there is likewise some risk of and because evaluating a firm's historic economic information is not exactly rocket science. Yes, people will always require to be included, yet with advanced technology, lower headcounts can potentially support customer interactions. That said, the Purchase Solutions group defeats audit in regards to pay, job, and exit opportunities.

If you liked this article, you might be curious about analysis.

Some Known Factual Statements About Transaction Advisory Services

Establish innovative monetary frameworks that aid in identifying the actual market price of a company. Provide advisory job in relation to service assessment to assist in negotiating and pricing structures. Clarify one of try this web-site the most suitable kind of the bargain and the type of consideration to use (money, stock, make out, and others).

Establish action strategies for threat and direct exposure that have been recognized. Carry out integration preparation to figure out the procedure, system, and business modifications that might be needed after the bargain. Make mathematical quotes of combination prices and advantages to assess the economic rationale of integration. Establish standards for integrating divisions, technologies, and business processes.

Examine the potential customer base, market verticals, and sales cycle. The operational due persistance offers crucial understandings into the performance of the company to be acquired concerning risk evaluation and value development.